Problem:

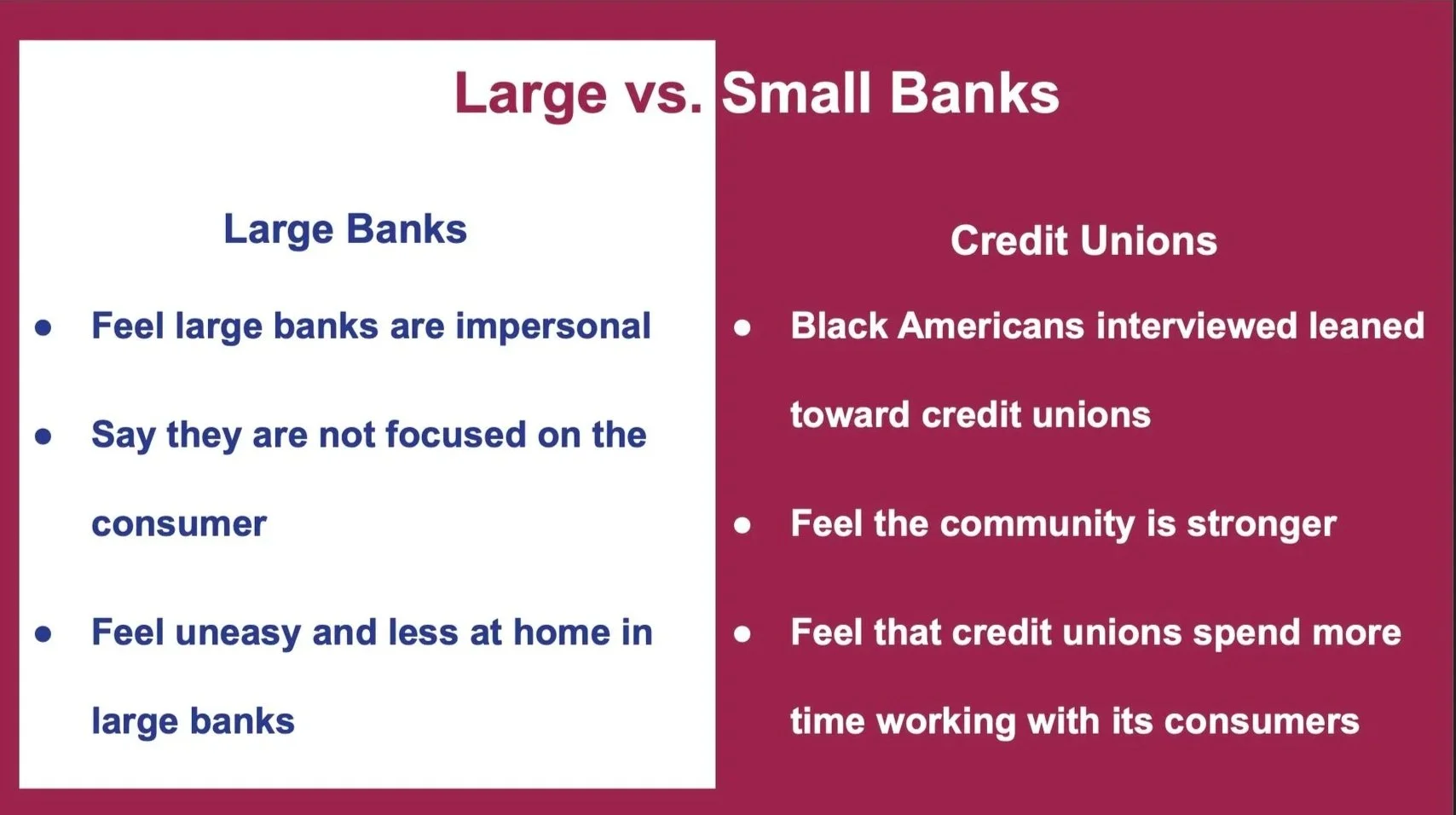

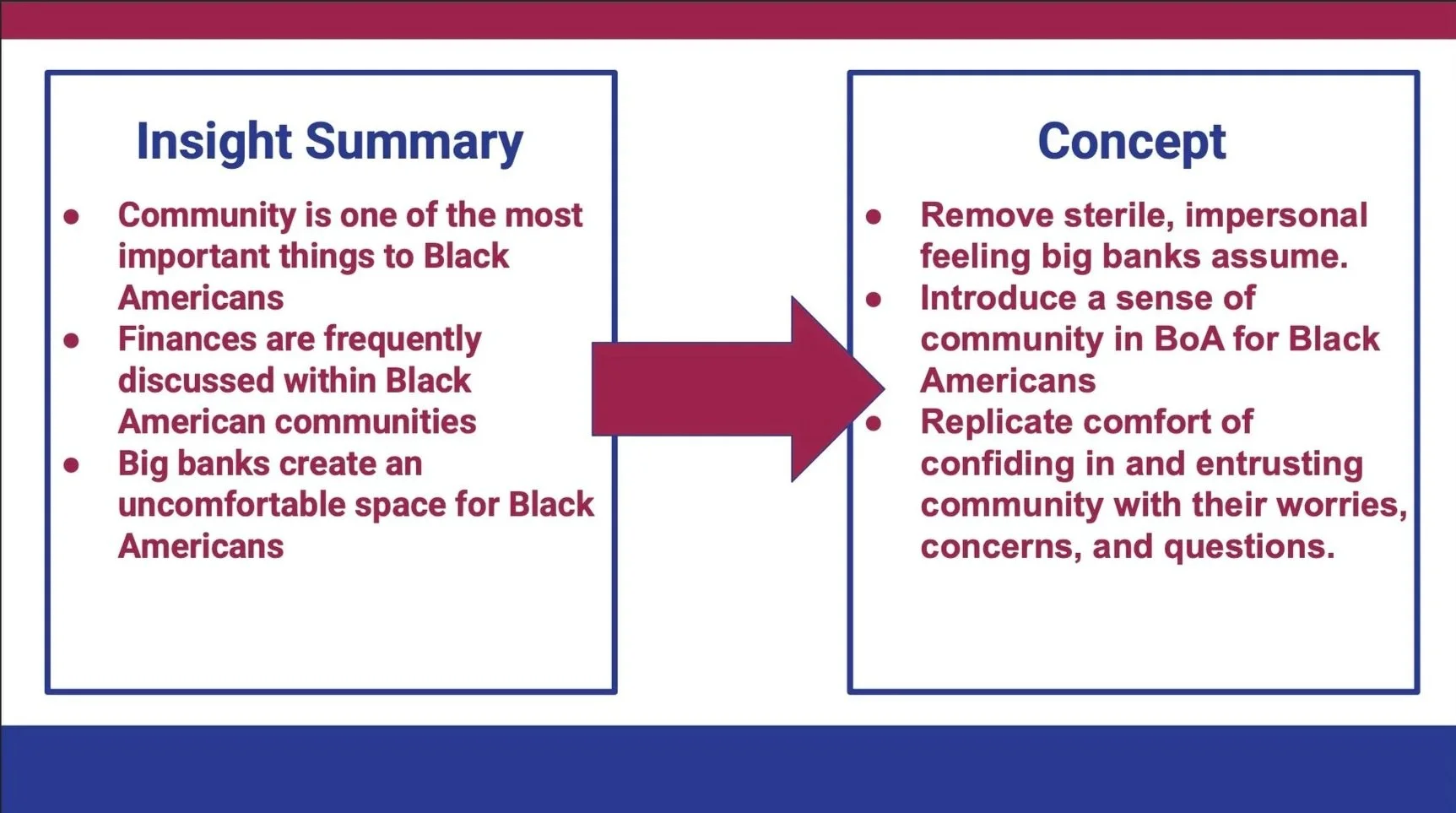

Black Americans see large banks as impersonal. Black Americans have gravitated towards smaller banks because of the personalized experience and small customer-base.

Creative Challenge:

Make Bank of America seem personable and knowledgeable about what Black Americans ages 30-45 are looking financially through advertising.

Objective:

Increase Black American owned Bank of America bank accounts by 2% by December 2024.

Target Audience:

Black Americans ages 30-45

Important Note: This was a peer collaboration for ADV 3411: Multicultural Advertising at the University of Florida. The work presented was collected and created in collaboration with my fellow teammates.

Bank of America

Situation Analysis & Secondary Research

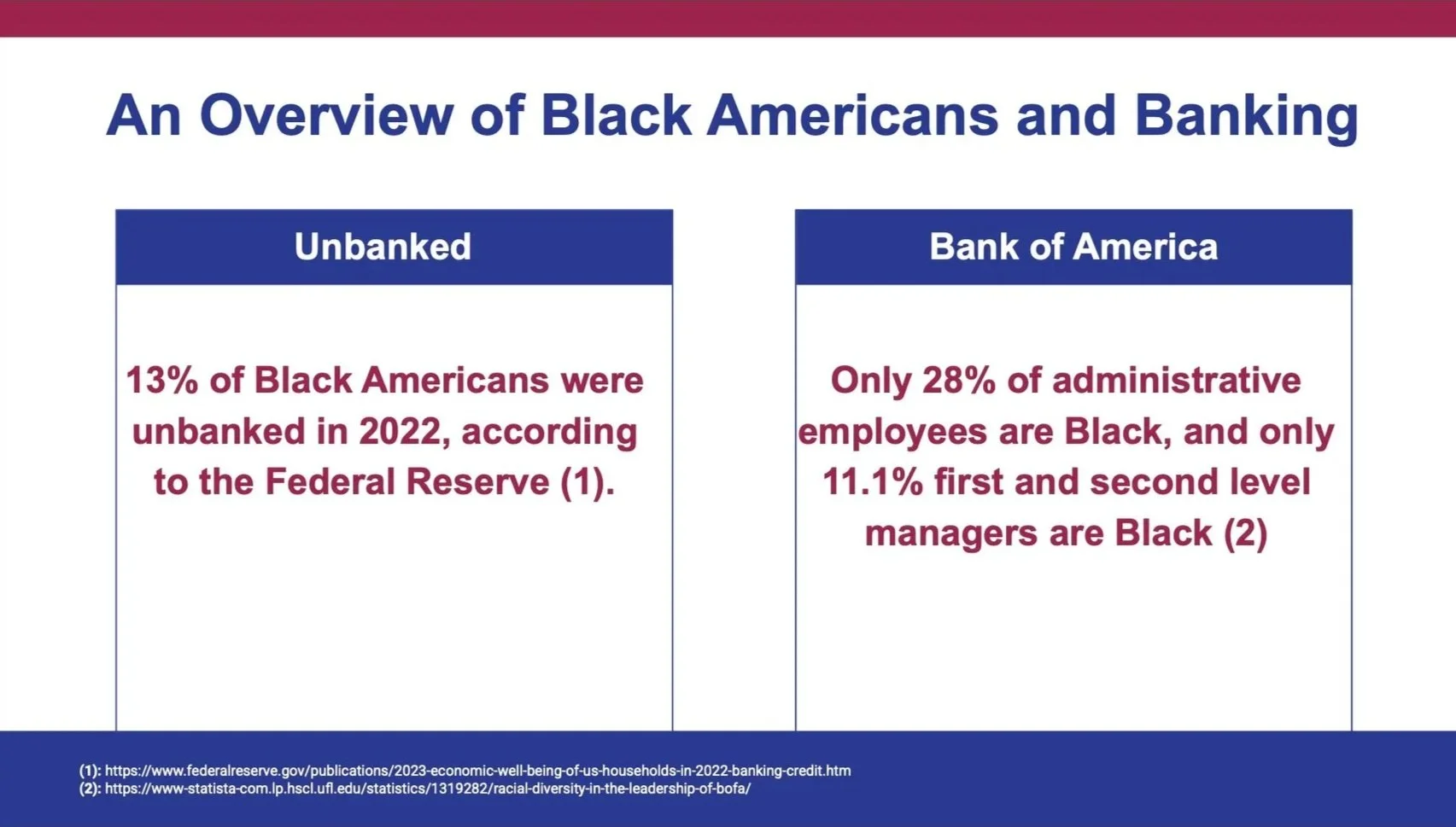

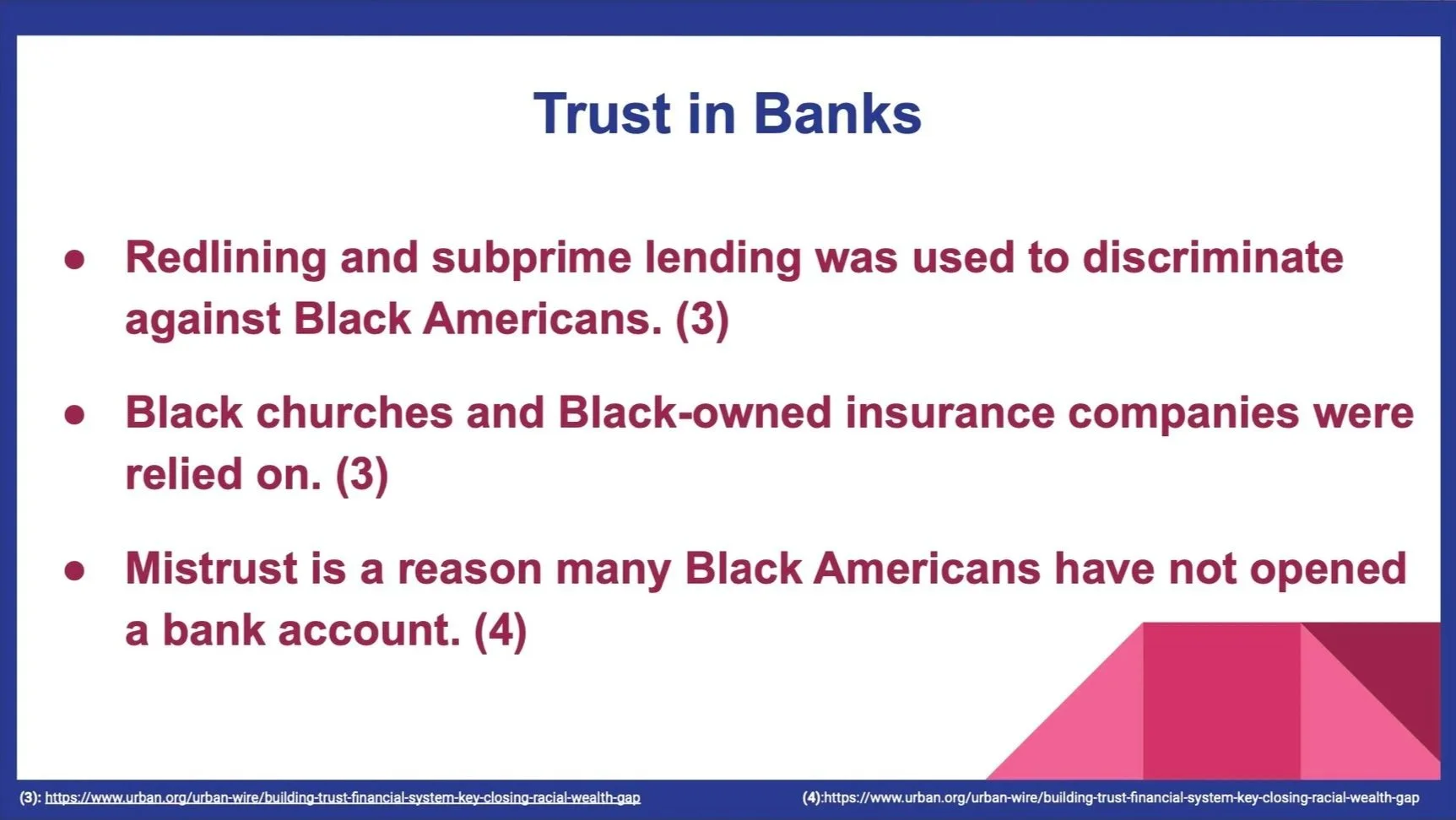

According to the analysis, 6% of Black Americans were unbanked in 2022. A significant factor contributing to this is the longstanding mistrust many Black Americans have toward financial institutions. Opening a Bank of America account, for example, requires a $100 minimum deposit, a notable barrier when considering that 1.21 million Black Americans reported unemployment and many Black households earn less than the national median income.

An addition to financial obstacles, accessibility and representation present further challenges. Many communities lack nearby bank branches, and only 28% of administrative employees in banks identify as Black. This lack of representation contributes to a sense of disconnect, making Black Americans less likely to engage with institutions like Bank of America.

Primary Research

To gain deeper insight, we conducted interviews with six Black American women- some with bank accounts and some without- who work across various industries. One of the interviewees was a banking industry professional, providing valuable expertise on the client-side experience. Each interview lasted approximately 30-45 minutes and included a mix of demographic questions, category-based questions about brand and product preferences, and inquires into their use of specific financial services. The final section focused on communication preferences, exploring how participants prefer to receive financial information and which forms of advertising they find most effective.

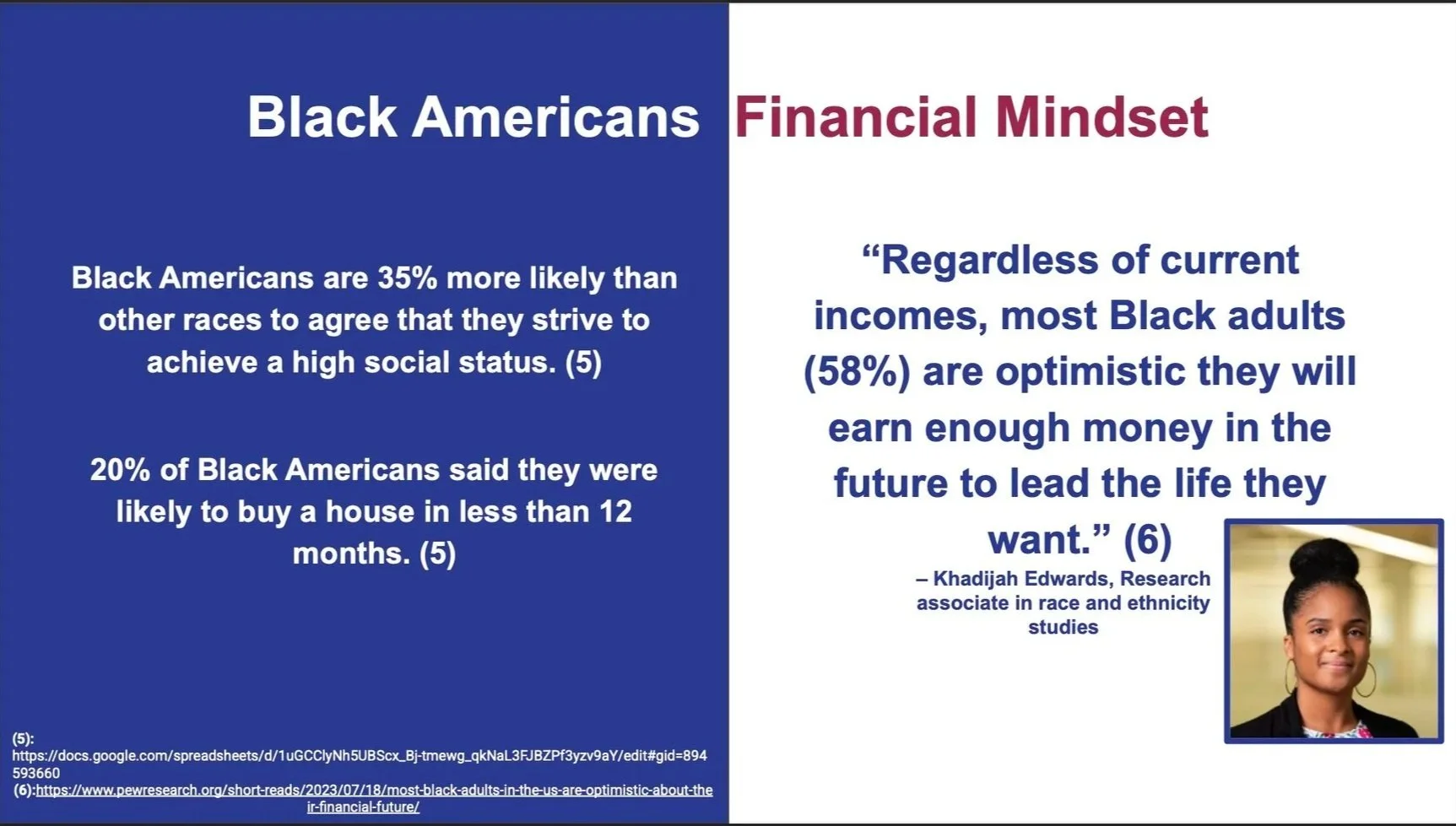

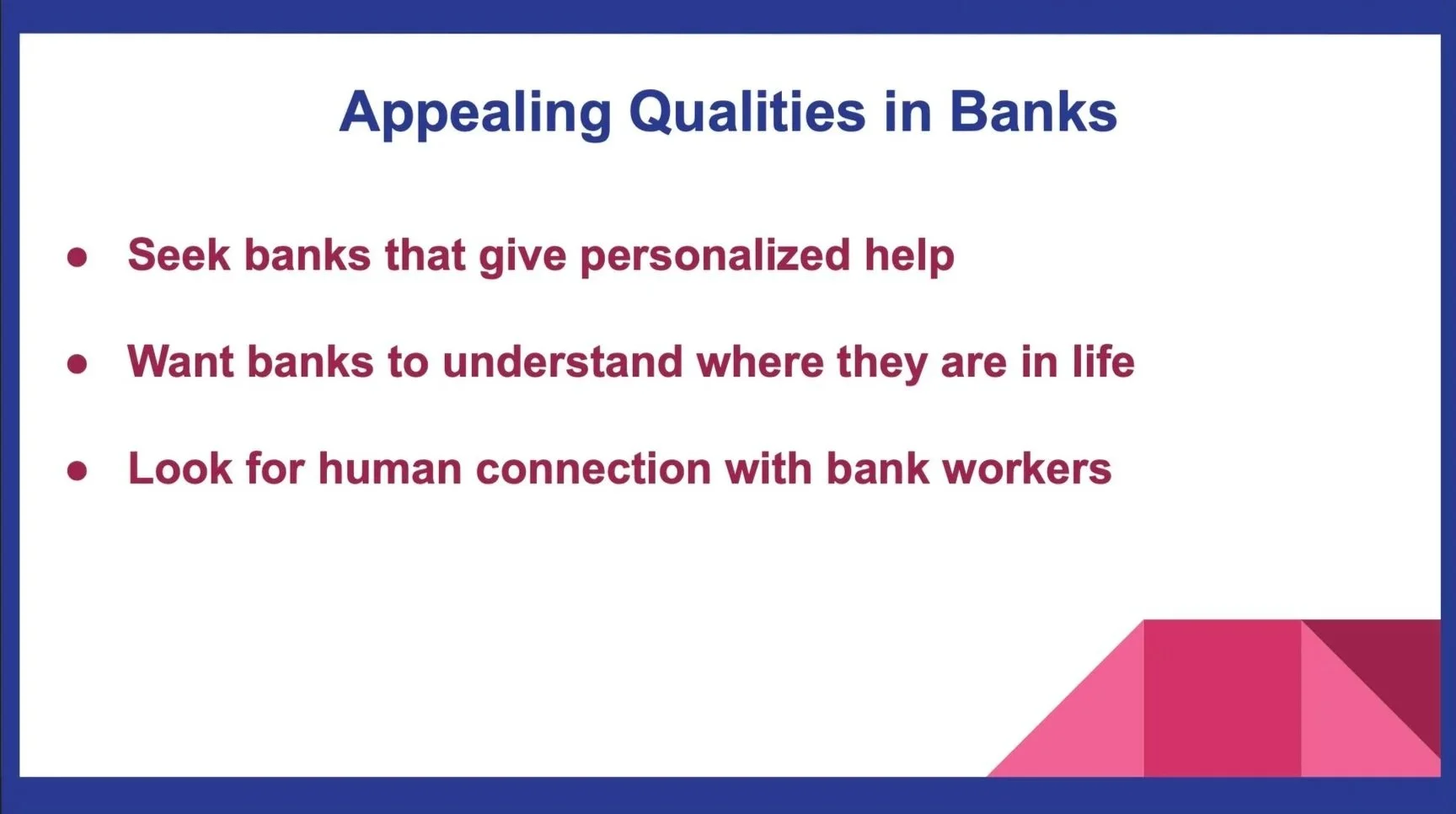

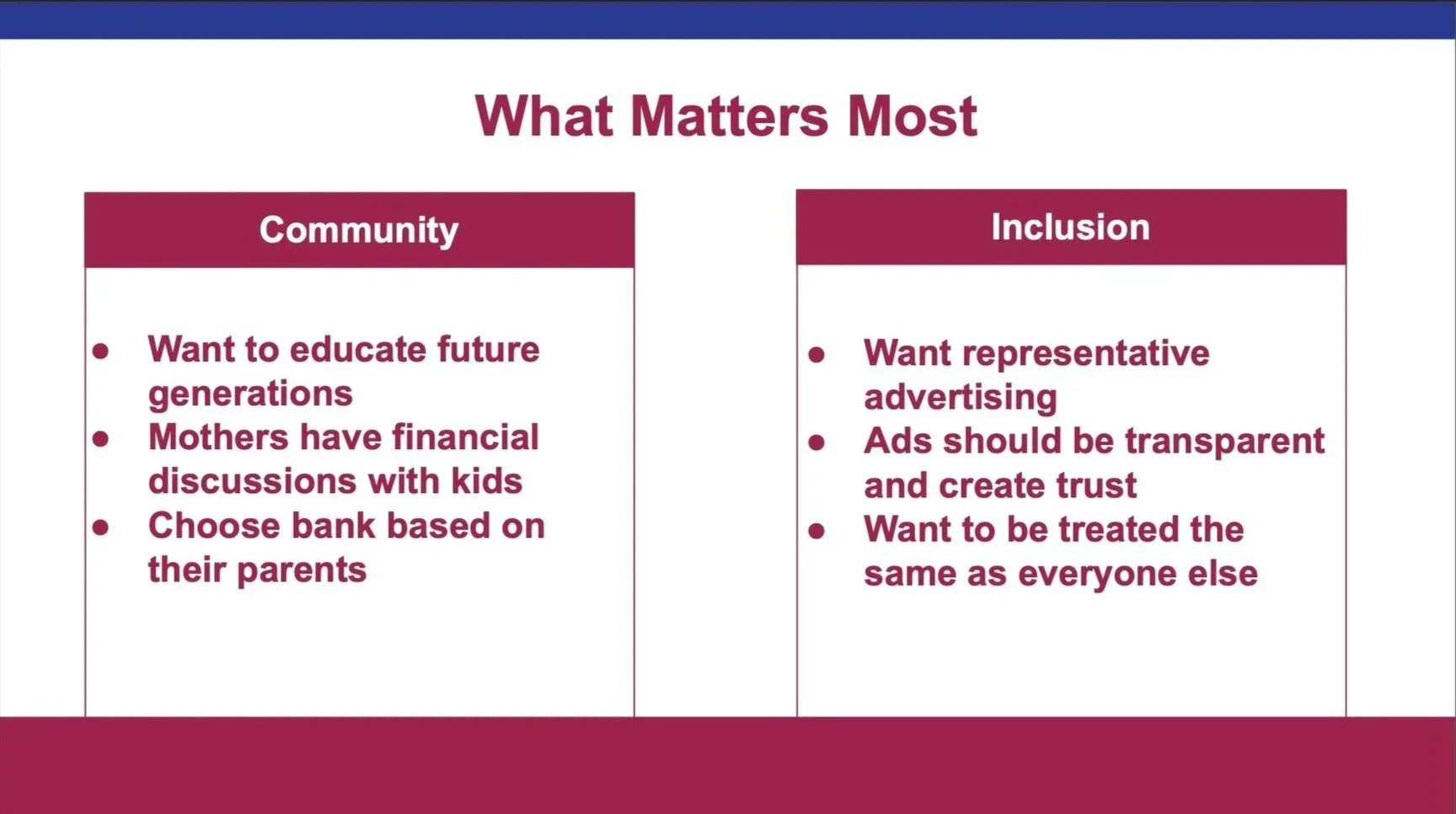

From this research, we learned that community plays a central role in financial decision making for many Black Americans. Financial habits were often shaped by conversations within their communities, particularly with family members; mothers often emerging as the key decision-makers. Most interviewees had no prior experience with Bank of America and preferred banking with credit unions or TD Bank, citing personalized services, reliability, and accessibility as key reasons for their choice. Representation in advertising also emerged as an important factor, with participants expressing a strong desire to feel seen and included in financial messaging.

Final Solution and Remarks

Proposed Solution: Based on these findings, Bank of America should position itself not only as financially knowledgeable but also approachable, demonstrating a genuine understanding of the financial needs and values of Black American communities. Messaging should prioritize inclusion, representation, and trust.

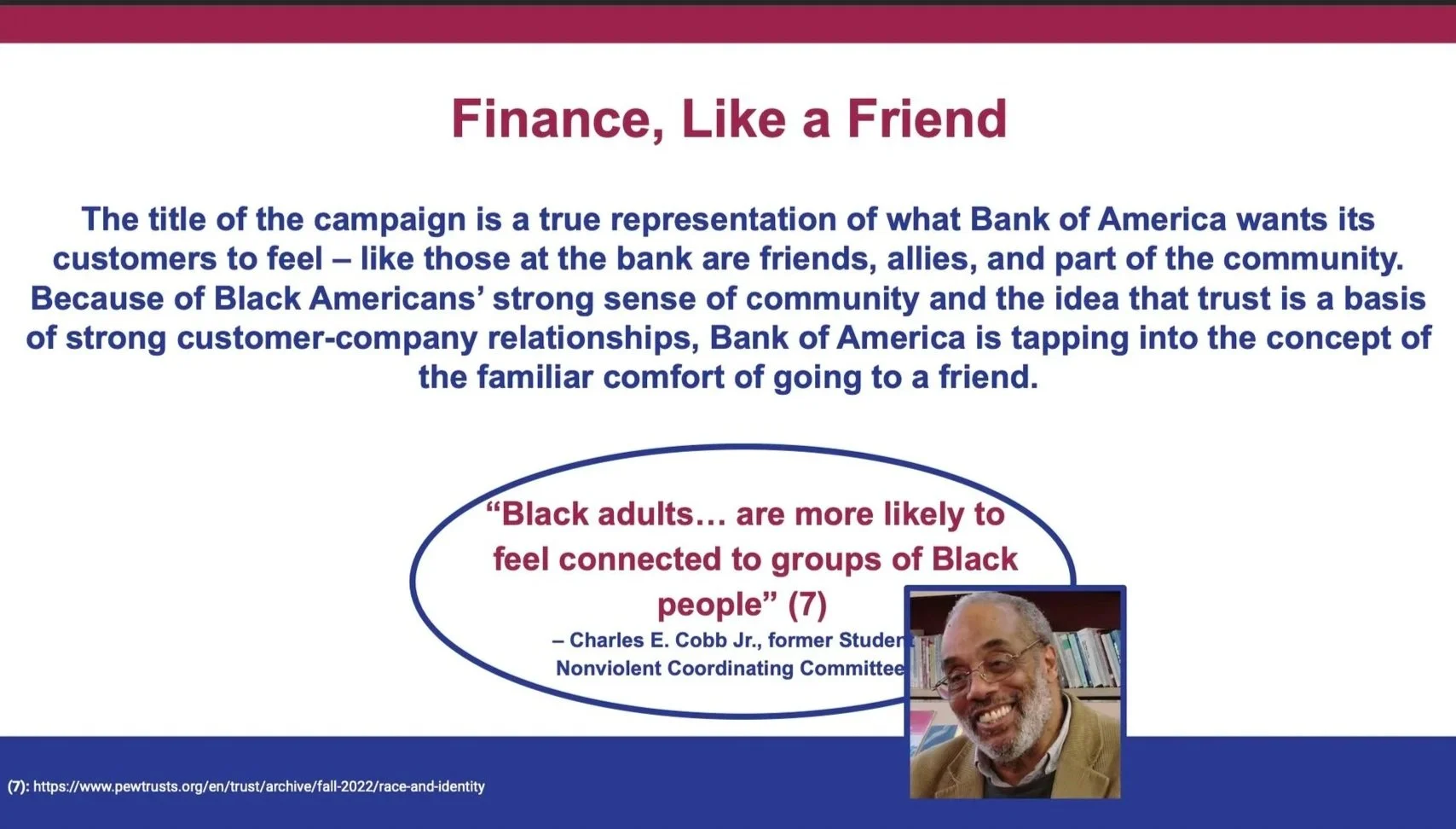

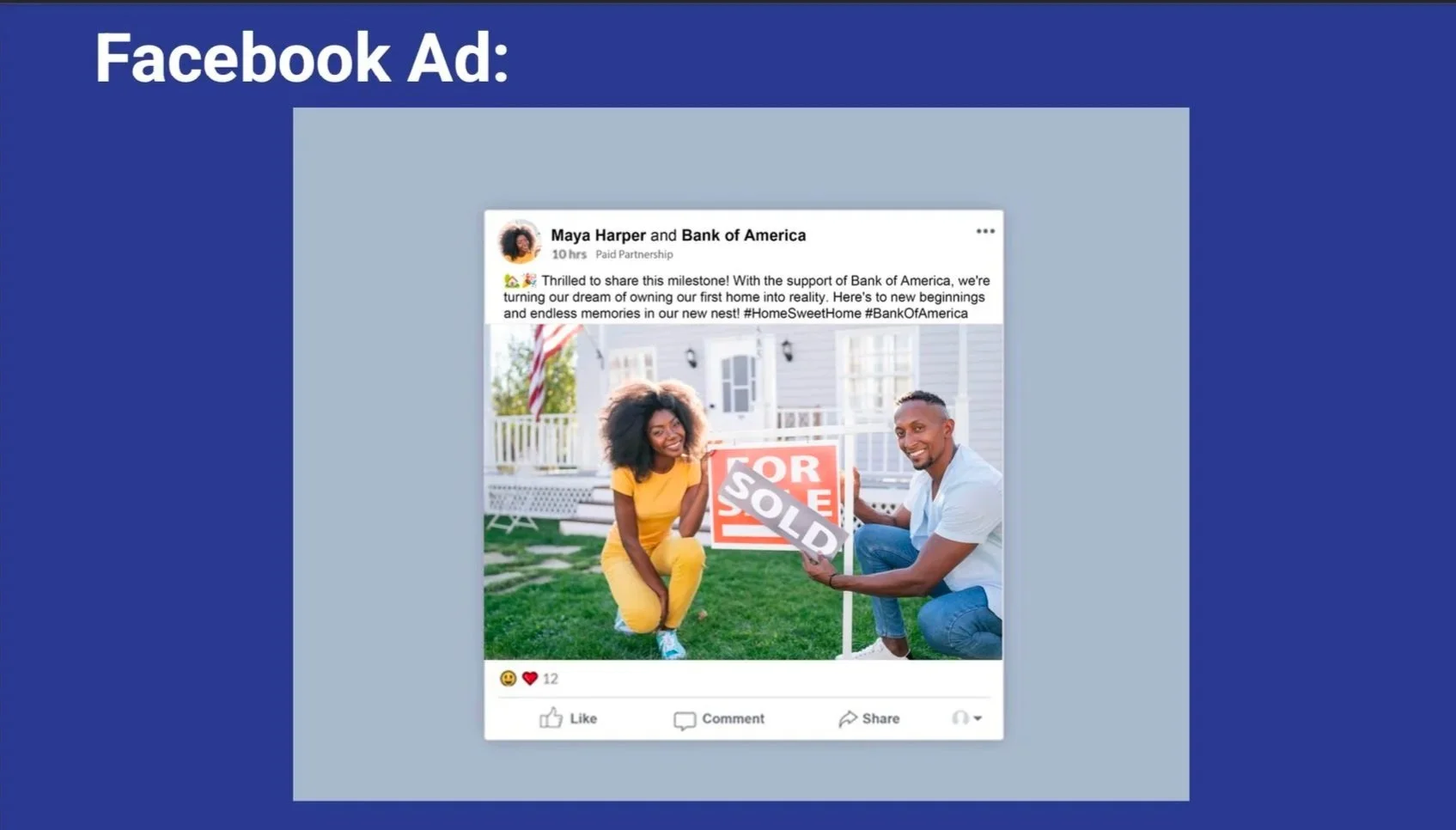

Campaign Title: Finance, Like A Friend

The campaign title reflects the core ideas: Bank of America should feel like a trusted friend: approachable, supportive, and invested in the financial well-being of its customers. By fostering a sense of familiarity and understanding, the goal is to rebuild trust and strengthen relationships within the Black American community.

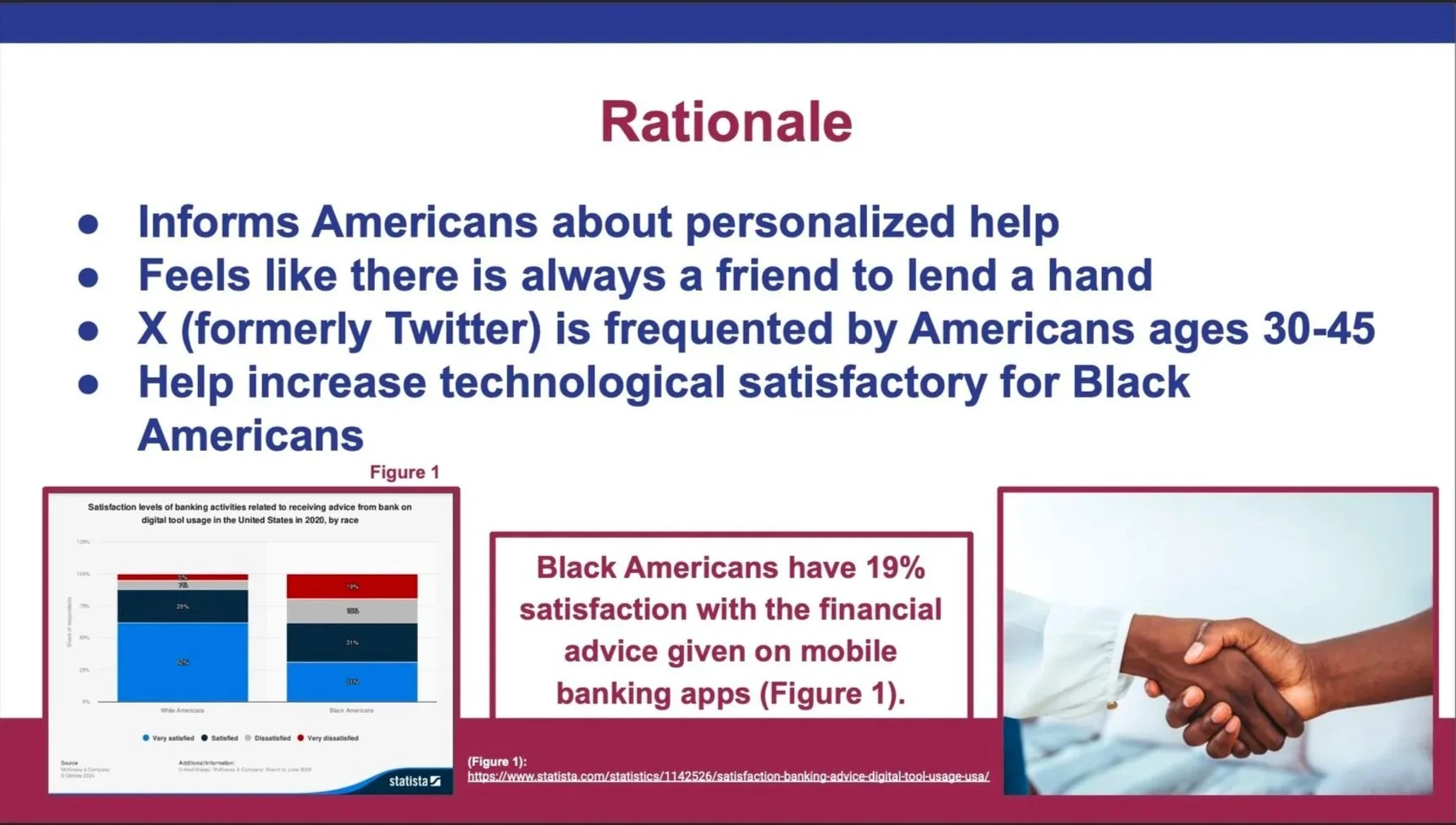

The campaign will highlight key life milestones among Black Americans ages 30-45, from homeownership and career moves to family celebrations, each mirroring the way these moments are proudly shared within communities. Content will be shared across Facebook and X (formally Twitter), where much of our target audience is already engaged.